Executive Summary

Luxury fashion is an industry known for its tradition and history, dominated by aspirational brands that convey status and style such as Gucci and Chanel.

Under its veneer of glitz and glamour lies an economically attractive profit pool; the overall industry is expected to be worth US$350bn by 20251. COVID-19 has accelerated the move to online similar to other industries, with this segment forecasted to contribute ~30% of total industry revenues by 2025.

This is where Farfetch enters the picture, with the company having only ~5.5% of the online luxury market share today.

Founded in 2007 by José Neves (who remains the CEO), Farfetch is the leading global platform for purchasing luxury fashion online. As compared with traditional online luxury retailers, Farfetch’s key differentiator is that its partners (both brands and boutiques) have complete inventory and pricing control. This is crucial for luxury brands, for which brand equity is the top priority.

The Farfetch of today is much more than its strong position as a third party marketplace, catering to multi brand, mono brand, online, and offline (Store of the Future) distribution, its own first party brands and enterprise clients through Farfetch Platform Solutions .

There are two key attributes that attract me to Farfetch:

Farfetch adds significant value to the luxury Ecosystem

Farfetch has spent its first decade and a half building out its core capabilities, including cultivating long term relationships with luxury partners and brands and developing a robust platform to enable its vision of connecting consumers with unique luxury products globally at scale.

An important focus of this has been building out capital intensive global logistics and technology capabilities. These characteristics are not easily replicated by competitors as they require time, capital (both financial and human), expertise and trust.

Farfetch has spent over a decade building and nurturing long-standing relationships with the world’s best brands, gaining their trust and developing a strong reputation. This has resulted in high-end brands viewing Farfetch as a strategic partner rather than simply a sales channel.

Farfetch has invested over US$1bn of capital building and refining its technology and logistics capability, which is extremely hard for competitors to disrupt. In an industry characterised by a long tail of boutiques and small family owned businesses, providing a platform to leverage scale benefits and a global customer base is extremely valuable.

The luxury sector has its own idiosyncrasies. Brand is paramount and the in store experience has historically been the primary channel for both brands and boutiques. Farfetch’s omnichannel value proposition is hard for competitors to dislodge while it also provides consumers with convenient access to differentiated luxury product.

Long Term vision and aligned incentives

José Neves is a visionary CEO with a unique understanding of both technology and luxury retail. Financially, Neves has a ~US$2bn stake in the company as well as recently entering into a new compensation agreement where he doesn’t take a base salary and has PSU hurdles vesting at subsequently higher stock price hurdles out to 2028, with the first hurdle $75/sh, +92% above last close.

The TLDR

Farfetch is currently unprofitable on a GAAP basis with every dollar of cash flow being reinvested back into the business at attractive rates of return (LTV/CAC < 6 months consistently). However, it is well positioned to establish itself as the premier global luxury platform, with the online luxury market expected to grow at a ~16% CAGR out to 2025 respectively. I expect Farfetch to grow share from 5.5% to over 10% during this period, underpinning top line growth rates of ~20%.

Since hitting COVID highs of $73.35 on Feb-19th this year, the stock has fallen by ~50% impacted by a confluence of factors including- a rotation to ‘reopening trades’, its involvement in the Archegos hedge fund liquidation and recent negative news flow relating to the Chinese government potentially regulating high networth luxury consumers. The company now trades on FY22e EV/Sales and EV/GP multiples of 4.7x and 10.4x respectively.

I believe Farfetch is transforming luxury while adding value for its whole ecosystem, and will explore why in this writeup.

A table of contents is outlined below.

Business Overview

Ecosystem Value Proposition

Farfetch as a Platform

The Competition

Key Financials Snapshot

Management & Incentives

Valuation

Business Risks

Business Overview

“Farfetch exists for the love of fashion. We believe in empowering individuality. Our mission is to be the global platform for luxury, connecting the creators, curators and consumers.”- José Neves

Farfetch lies at the intersection of luxury fashion and technology, a company fashioned (no pun intended) in the mould of serial entrepreneur José Neves.

Recognising a gap in the market between mass market online retailers and traditional luxury operators unwilling to adopt technology, Neves founded Farfetch in 2007, and launched the platform in 2008.

“Back in 2007, I saw that the Internet was going to permanently change the industry as it has changed every other industry and that fashion has only just begun embracing the channel. I could see a transformation coming in terms of how consumers discover fashion and how transactions would take place. What was also striking was that there was no marketplace or platform for this very resilient industry. To me, this was and is a huge opportunity as this is an industry which lends itself perfectly to marketplace dynamics.”- José Neves (emphasis mine)

Farfetch is primarily known for its global digital marketplace connecting consumers with sellers (brands and boutiques). However its reach extends far beyond this, highlighted by a number of its business segments outside of the core third party marketplace.

Brand incubator New Guards Group (NGG) accelerates the flywheel of consumers looking for new emerging brands (e.g. Off White) and provides Farfetch with further differentiation from e-tailers (who purchase inventory from luxury brands to resell online)

Farfetch Platform Solutions (FPS) provides a modularised full service suite of services (e.g. white labelling websites) to brands, boutiques and department stores

Luxury New Retail focuses on creating a truly omni-channel experience, leaning into Neves’ view that consumers want flexibility in the way they shop for luxury. Store of the Future is the flagship concept of this initiative

Browns (retailer owned by Farfetch) serves as a testing lab for new products and ideas that can be rolled out the broader platform if successful

Revenue Model

Farfetch generates the majority (~67%) of its revenue from transactions between sellers (first party and third party) and consumers conducted on the platform, receiving a ~30% take rate on 3P sales. The company also has a number of other businesses with different margin profiles outlined below.

Ecosystem Value Proposition

Brands

Consumers prefer a multi brand environment

The vast majority of consumers prefer shopping in a multi brand environment as they are presented with variety and the ability to purchase with more ease than entering separate boutiques (virtually through an app or in person). Given a consumer’s propensity not to download multiple individual brand.com apps, Farfetch provides a convenient way for brands to display their inventory to a wider audience and capture sales. In contrast, Brand.coms (company branded websites) are much more about experience and immersion than they are about merchandising and selling which is much more challenging to translate online.

DTC e-concession model places Brands in control

The Farfetch marketplace is distinct from e-tailer competitors given its direct to consumer (DTC) premise. Luxury sellers are able to achieve incremental sales by making their inventory available to a global audience, optimizing inventory without increasing their physical footprint. This is a win-win proposition for the retailer, consumer and brand.

The marketplace model enables brands to sell on third-party multi-brand platforms under a retail structured agreement, in which crucially, the brand has control over pricing and display (similar to a concession section of a department store). This value proposition is much more compelling to brands in the long term as they have access to more comprehensive data allowing them to understand their customer in ways that were previously not possible.

Better margins

In an industry delivering ~70% gross margins, Farfetch’s take rate of 30% implies brands can still realise an EBIT margin of ~40% on incremental sales made via the platform (I expect the larger brands which drive higher traffic can command more favourable terms). This is nearly double what they would receive through a wholesale e-tailing channel.

Enabling emerging brand distribution

The luxury industry is characterised by a few dominant players (e.g. Louis Vuitton, Chanel, Hermes, Gucci) but there is also a long tail of niche luxury brands which will require an online distribution strategy to drive sales globally.

These smaller brands and particularly new entrants do not have the benefits of a global store network, logistics capabilities or direct online operations. Farfetch offers brands a global partnership, able to deliver sales across regions and provide emerging brands with access to a global market.

Customer acquisition

Farfetch can help brands acquire new customers. Using an example to illustrate this, if a customer is on gucci.com they have strong intent is to purchase Gucci and more often than not they will. However on Farfetch, the same consumer might just be typing "red loafers”' or "pink dress" and actually could look at five to ten different brands, and then end up buying Gucci.

Boutiques

Farfetch’s value proposition was tested when it started introduced e-concessions onto the platform, thereby making boutiques essentially compete with brands. Even with this development, the increased volumes and revenues that boutiques received made the economics of staying on the Farfetch platform too attractive to leave. Less than 5% of boutiques leave the platform each year voluntarily.

Large audience and more customers

Most boutiques sell 20-30% of their inventory through the Farfetch channel versus in-store. For the commission paid to Farfetch, boutiques receive access to a global audience and customer base, which would have previously been impossible.

E.g. An offline local boutique based in Florence would likely serve the same local families and occasional passing tourists. Now suddenly they're part of Farfetch and traffic is now 40 million visitors globally every month. This is a game changer.

Incremental sales and foot traffic

Being on Farfetch results in incremental sales, and potentially encourages more customers through their doors as it is possible to collect or return goods ordered via Farfetch at its partners’ physical stores. Orders placed through Farfetch also bring incremental profit at a higher than normal margin (as discussed above).

Ability to take more inventory risk

Boutiques can now also meet minimum order thresholds from larger brands which they would have been unable to commit to previously given their larger scale.

Consumer

Larger range, personalised experience

Farfetch has eight times the number of SKUs than its nearest competitor, making it the go-to destination for multi-brand luxury product discovery. Further, Farfetch seeks to replicate the in store luxury experience. Every time a consumer goes onto Farfetch, the site is personalised and is specifically curated for that customer. The end to end approach of quick and efficient delivery, customer service, and easy returns, are aimed to be at the level a discerning luxury consumer would expect.

Multi brand experience

As discussed above, most consumers (luxury or otherwise) shop in a multibrand way looking for inspiration and discovery.

Catering to digital savvy consumers

The Gen Z millennial age bracket will be driving the vast majority of luxury fashion consumption. As such, having a way to distribute amongst this digitally native, digitally savvy group is an important thing for the industry to be focus on moving forward.

Convenience and speed

Through years of investment, Farfetch has built a logistics capability that’s unrivalled in the luxury world. Consumers can now receive high value luxury items within a few days (and sometimes quicker) depending on where they live.

Farfetch as a Platform

The interconnections within Farfetch can be confusing and it’s worth spending the time understanding how they all fit together and contribute to Neves’s broader vision. I view Farfetch through the below segments and stakeholders (although the company reports differently).

Farfetch Marketplace (Core)

Core Marketplace

Farfetch is a two sided digital marketplace connecting buyers (demand) and brands/boutiques (supply). For every $100 of GMV, Farfetch takes ~30% at the group level for 3P inventory. There two key elements of the platform:

Marketplace (1P/3P): Inventory in the standard marketplace can be found in a multi-brand environment where Farfetch decides how the brand is displayed and priced. This also includes Farfetch’s first party sales through the platform including Browns and brands within NGG. As these brands are owned by Farfetch, for the sales Revenue equals GMV.

Brand E-concessions (3P): Some luxury brands (e.g. Saint Laurent) have their own section of the website with the intent to emulate the experience of their real life concession boutique at a department store. Here, brands control pricing, assortment and the supply chain while Farfetch provides the platform infrastructure, tools (product management, secure payment system etc.) and a customer database.

There are ~550 brands on the e-concession model which includes 97% of the top 30 brands on the Farfetch platform.

Brands are an increasing part of the business, with half of supply now coming from direct brand relationships. Brands actually have a higher margin than boutiques as they utilise ancillary services (e.g. FPS, media solutions), which means the overall take rate with the majority of the brands is actually materially higher than the boutiques.

China

China is the single most important luxury market in the world, forecasted by Bain to account for US$170bn (nearly 50%) of a US$350bn luxury market by 2025.

The average luxury consumer in China is 10-15 years younger, much more digitally connected, and less brand loyal- giving rise to the importance of a multi brand environment that has a frictionless mobile experience

70% of Chinese consumption in 2019 was done while travelling abroad, representing a staggering $70 billion in luxury purchases. As a result of COVID-19 and the collapse of international travel, there is a repatriation of this demand. Digital channels will take the lion's share of this latent demand given how vast China is as well as how underdeveloped its physical luxury brand store networks are

Average Order Value in China is ~$720, 30% more than the average global Farfetch customer. Around a third of the China GMV comes from private clients who are very sticky as they typically visit Farfetch more than once a day and order nearly once a week

A Brief China History

Farfetch entered the Chinese market in 2015 with zero brand awareness and formed a strategic partnership with shareholder and Chinese e-commerce titan JD.com in mid-2017, which enabled Farfetch to leverage JD’s local logistics network. However, this partnership faced some constraints because of JD’s small luxury customer base and lack of history and brand awareness in the Chinese luxury sector.

In early 2018, Farfetch made a significant move in its China journey, acquiring marketing firm CuriosityChina. CuriosityChina specialises in leveraging WeChat to find high intent users and sell goods, enabling Farfetch to provide plug and play access for luxury brands via an integrated platform servicing Chinese consumers via Web, App, WeChat Store and Mini-Programs.

Farfetch now powers 90 luxury brands on WeChat. Strategically, CuriosityChina was an important acquisition given 1) its expertise in distribution and 2) the importance of mobile in e-commerce, with 90% of transactions flowing through the channel (versus ~50% globally).

Perhaps even more importantly, CuriosityChina co-founder Judy Liu became MD of Farfetch in China upon acquisition, a position she holds today.

As intimated earlier Farfetch’s partnership with JD was not going as well as expected given its smaller luxury customer base and history versus Alibaba.

New China Deal

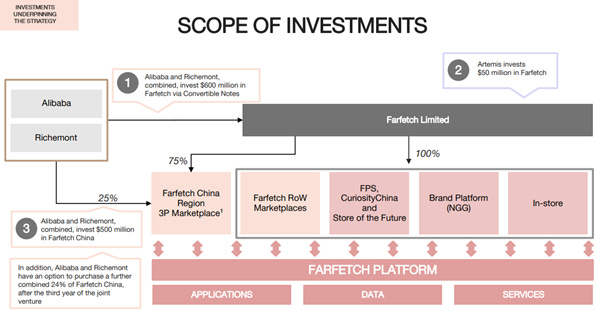

In November 2020, Farfetch, Alibaba and Richemont (owner of brands such as Cartier and Van Cleef) announced an alliance in online luxury. The deal includes the creation of a Chinese JV and a partnership called Luxury New Retail.

Operationally, the partnership includes two key elements:

Farfetch launched on Tmall Luxury Pavilion (TLP), Tmall Luxury Soho (outlet channel) and Tmall Global in March 2021.

Farfetch and Alibaba created Luxury New Retail, a global partnership to support luxury brands shift to online and omnichannel. Along with Jose Neves (Farfetch CEO) and Daniel Zhang (Alibaba CEO), this partnership includes Johann Rupert (Chairman of Richemont) and Francois-Henri Pinault (CEO of Kering and Chairman of Artemis).

The Economics

The JV covers both TLP/Lux Soho and Farfetch trade on the app, WeChat and China website.

The China entity does not hold other aspects of the Farfetch platform,

Farfetch will pay a demand generation fee to Alibaba

Farfetch will then, from the JV, pay up to Farfetch a platform services fee related to use of technology, brand relationships, editorial and other things that enable the trade to happen.

The Value Proposition

Nearly all the 3,500 brands on the Farfetch platform are available to Tmall's ~780m customers – with 90% of these brands not having a presence on Tmall previously.

Farfetch is one of only five buttons on the home screen of the TLP app.

Brands will now be able to access a luxury savvy consumer through one integration;

Brands will be able to capitalise on a much larger SKU range through the Farfetch Marketplace within TLP rather than selling directly to the consumer;

Border customs in China are extremely complicated. Farfetch can provide a stable service and smooth delivery to customers, which is especially complicated and hard to replicate. Average delivery time is 2 to 3 days to Hong Kong and 4 to 6 days from around the world to Mainland China.

Farfetch Platform Solutions (FPS)

“For me, FPS could be a stronger growth of business in terms of Farfetch overall than the marketplace as we move forward.”- CFO Elliot Jordan

FPS is a modular suite of white label enterprise solutions for luxury fashion brands and retailers. It currently has 21 customers including Harrods, Chanel, and Kering. FPS acts as an operating system for brands, retailers and boutiques to easily improve their digital and omnichannel offering, akin to a Shopify for luxury.

These solutions are built using the Farfetch infrastructure, enabling a brand’s website to have similar functionality and scale as the Farfetch Marketplace. Partners can choose from specific features, bundles, or an end to end solution enabling a full e-commerce experience. The monetisation of individual products and services is negotiated and can include revenue share, build, agency and consultancy fees.

New Guards Group (NGG)

In early 2019, Farfetch acquired brand incubator New Guard Group for $675m featuring popular street wear brand Off-White – the brainchild of Virgil Abloh, an American fashion designer, entrepreneur, artist and DJ who has been the Artistic Director of Louis Vuitton's menswear collection since March 2018.

NGG operates an asset-light model and sources all of its merchandise from independent contract manufacturers. This results in low inventory on hand (~8-10% sales) in relatively modest working capital requirements.

Strategically, the acquisition of NGG was met with immediate skepticism by investors, judging from a -45% decline in share price on the day (although at least some of this can be attributed to the resignation of Chief Operating Officer Andrew Robb).

However, with the benefit of hindsight, NGG has proven to be an astute purchase. New Guards Group brands bring cultural relevance to the Farfetch brand by providing sought-after product and exclusive access to merchandise, which can drive significant visibility and consumer engagement with limited marketing investment.

“One of the core strategies behind the transaction was to create a pipeline of original content and exclusive collabs that will increase the engagement of our global customers around the Farfetch brand and ultimately drive more organic traffic.”

One of the big challenges that all multi-brand retailers have is that most customers are much more brand-centric than they are retailer-centric. This makes exclusive content, partnerships and brands (the Netflix strategy) incredibly important to differentiate themselves.

In practice, this idea has rung true thus far with Farfetch achieving its highest traffic when there are new releases within the brand platform or collaborations (e.g. the Off White x Nike collaboration) rather than a more generic sales day like Black Friday.

Luxury New Retail/Store of the Future

“LNR represents our vision of delivering a global presence for brands and retailers by virtually unifying their customers' interactions across all channels, both on and offline with one single integration.” - José Neves

LNR’s vision is to serve mono and multi-brand distribution strategies for luxury brands and retailers, including fully connected e-commerce websites and apps, omnichannel retail technology, and access to the Farfetch and Tmall Luxury Pavilion marketplaces via a single integration to the platform. This enables a brand or retailer to achieve a full 360-degree view of the customer and to deliver a hyper-personalised and seamless journey for the luxury customer across all channels.

Farfetch Access (Loyalty Program)

“The idea behind Access is to connect with the private client of today and tomorrow. Private client represents our highest-spending and most engaged consumer segment.”

As at January 31, Farfetch had 2.8m Access members, +180% over 2019 and now includes 90% of the Farfetch customer base. Farfetch also now has 146 stylists servicing VIPs in 29 cities. In 2020, the top 1% of consumers represented 27.2% of revenue. Access is still quite new, only launching in Spring 2019.

Access enables Farfetch to utilise a more systematic approach to identify prospects within the customers that have already been acquired, and then nurture them appropriately to maximise their LTV. Retention goes up materially after a customer’s third or fourth purchase.

The Competition

When discussing competition it’s important to note that all Farfetch’s online multi brand competitors are wholesale businesses that purchase inventory from brands to resell, although some are moving parts of their business to the marketplace model slowly.

Farfetch is the only global online luxury destination that operates a marketplace model at scale. Interestingly, there is recent media speculation that Farfetch is in line to partner with their biggest competitor YNAP, which is owned by Richemont.

Farfetch theoretically faces competition from multiple different business types.

E-commerce enablers: Shopify;

Mass market e-commerce: Amazon Luxury Stores;

E-tailers: Yoox Net-A-Porter, Matches Fashion, SSense, Mytheresa;

Multichannel luxury retailers: e.g. LVMH, Richemont, Kering.

In practice, the Farfetch platform enables the luxury ecosystem in ways other competitors cannot match, taking little inventory risk and leaning on its distribution network and technological capabilities to fulfil orders at a global scale.

However, it does fall short in a few areas at this stage, mainly:

The platform can be vulnerable to discounting;

Consumers are not loyal to the Farfetch brand;

Curation can be improved;

Discovery can be difficult given large SKU range;

Some key brands still not on the platform.

We explore some key competitive themes below.

Luxury industry seems to have moved away from periods of mass discounting

Whilst Farfetch is nearly 15 years old, the platform was still met with skepticism by a number of key luxury players until a few years ago. Trust and brand reputation are of the utmost importance in luxury, and this takes time to establish. Compounding Farfetch’s woes was a period of strong discounting in late 2018/early 2019 as e-tailers became aggressive with price.

Following this period (or because of it), combined with the increased prominence of e-concessions has established Farfetch as a viable alternative for retailers and brands seeking to control their own destiny. As discussed in a previous section, the Farfetch marketplace provides a strong value proposition, and perhaps most importantly lets brands and boutiques remain in control of their inventory, perhaps the most important thing to have in maintaining a luxury brand.

8x greater SKU range is a double edged sword

Farfetch has broadly an 8x SKU advantage over its nearest competitor Net-a-Porter. This is a double edged sword with the opportunity to purchase a unique differentiated item offset by lack of discoverability and less tailored curation.

Farfetch as a brand is still in development and savvy consumers are happy to browse multiple websites to get the cheapest price, especially when dealing with luxury items. Using Net-a-Porter as a case study, a luxury e-tailer’s value proposition is built around having a strong team of buyers and merchandisers, who pick key popular items and curate them effectively.

As such, the sell through on the inventory listed on Net-a-Porter is far better than the same items on Farfetch. On the other hand, the 90% of inventory that isn’t on Net-a-Porter is where all the unique pieces are, which appeals to the modern customer looking for exclusive, independent and unique items.

SKU range remains an interesting aspect of differentiation for Farfetch and one the company takes seriously. In my research, a material number of Farfetch engineers are working on the problem of how to make such a huge range of product surfaces in a way that it feels tailored and curated to every customer’s unique needs and taste.

Where E-tailers win versus Farfetch

From a look and feel standpoint, e-tailers such as Net-a-Porter or Matches Fashion have arguably better editing and curation due to having a smaller focused product selection. This enables them to invest more resources into editorial and quality of photography etc., which brands are pedantic about.

Shopify

Shopify’s ecosystem enables a boutique to put up a storefront in no time however reach and scale still have to be solved. FPS is a vertical specific solution that plugs a smaller boutique or brand into the broader Farfetch ecosystem enabling better discovery and promotion. Further, Farfetch has a compelling value proposition to access the important Chinese market (through both the Alibaba partnership and CuriosityChina), which Shopify cannot compete with at this stage.

Amazon

The Everything Store has naturally had a crack at luxury, launching Luxury Stores for select Prime customers last year. Initial traction has been soft and Amazon has not yet secured any leading luxury brands to the platform. In luxury, brand equity is paramount and this is at odds with the Amazon premise of lower prices for customers and wide selection. While anything Amazon does cannot be discounted, it’s hard to see the luxury industry and consumers embracing a luxury marketplace on the platform given its very different corporate DNA.

Key Financials Snapshot

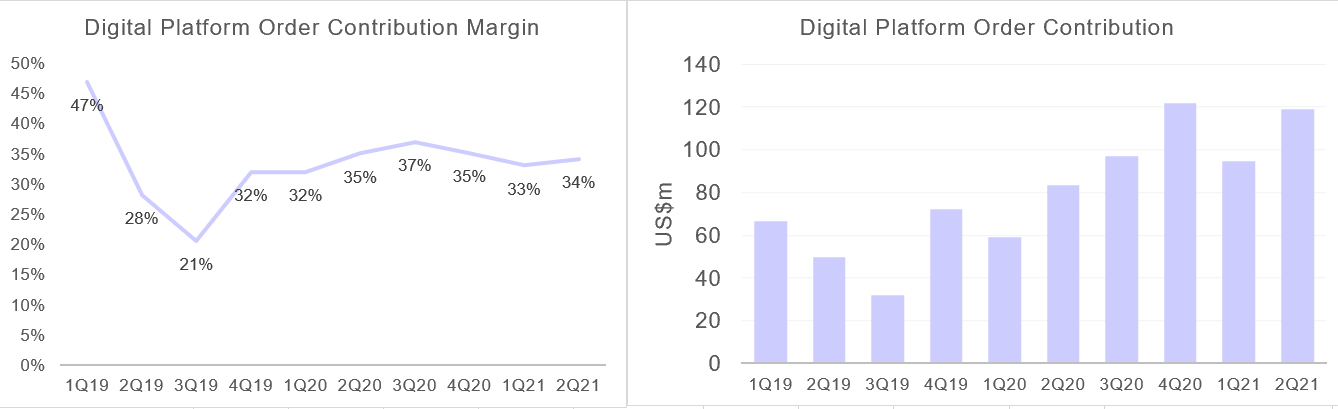

Unit Economics

Farfetch runs its business based on LTV/CAC models with payback of less than 6 months exhibited historically amongst most cohorts.

Farfetch defines lifetime value (LTV) as:

[LTV = Cumulative Platform order contribution]

[Cumulative Platform order contribution = (GP2 - DGE3 attributable to cohort) / Number of consumers in cohort]

Other Highlights

GMV is presented net of returns which I estimate to be 1/3 of items.

Key KPIs are around GMV position, order contribution margin and EBITDA position.

Farfetch operates with a negative working capital cycle.

Net cash of $436m as at 2Q21 funded by convertible note issuances.

Long term company target is 30% adjusted EBITDA and 60% digital platform contribution margins (materially higher than what Farfetch is reporting today).

Some older cohorts have been delivering order contribution margins of c.60%.

In addition to achieving efficiencies in demand generation, there are other drivers such as efficiencies in shipping and logistics, as well as ramping up higher margin businesses such as FPS and Media Solutions.

Diluted shares have increased from 224m in FY17 to 452m in 2Q21 driven by convertible note issuances, and employee share option schemes.

“How we run the P&L, it's a little bit like conducting an orchestra, really. There's quite a lot of moving parts. But I think the key thing that we do focus on is maximizing that order contribution, both from a cash point of view, but also the order contribution margin” - Elliot Jordan, CFO, 3Q18 Earnings Call

Demand generation expense

Farfetch principally acquires consumers through online channels, including paid and organic search, metasearch, affiliate partnerships, display advertising and social channels. These expenses are set to decrease as a percentage of revenue over time. Farfetch expects this to be driven by better utilisation of its data to target customers and shift towards lower cost and organic channels as well as investment in its own brand, with the company’s third brand campaign Only On Farfetch recently launching.

Technology

Relates to maintenance and operations of platform features and services, as well as software, hosting and infrastructure expenses, and includes three data centres. Farfetch expects to increase its data scientists and engineers to 2,200 people by the end of 2021 (from 1,772 in 2020).

G&A

The main component is general corporate expenses and includes platform services, production, customer services, account management and brand marketing campaigns. These expenses are set to decrease as a percentage of revenue over time as prior investment in infrastructure is leveraged.

Share Based compensation (SBC)

SBC is a real cost to the business. I reverse this add back to calculate operating cash flow and view it as a financing cash flow. See here for more detail on this.

Management & Incentives

“The idea of a platform connecting inventory sitting in disparate physical stores to one single, global ecommerce website, in real-time, was completely new and, for an industry that saw the internet as a threat or some sort of “heresy,” the Farfetch concept was mind boggling.” - José Neves

We believe the world will continue using physical retail stores. Fashion cannot be fully digitised, unlike music or video. There is something magical about the physical retail experience. “- José Neves

“Like the things that he does, you might sometimes think that he's a bit mad and then in 3 years' time, you realize that it was a great idea.”- Ex Farfetch employee on José Neves

“José is amazing. I think he's genuinely a unicorn guy, like he's super smart. He is incredibly rare, and he really understands tech, computing and software. He really understands fashion genuinely, like he can go toe to toe with the other global brand CEOs. But he's also a very really compassionate visionary leader, and a very smart guy, he's a good trader.”- Ex Farfetch employee

Founder and CEO José Neves holds ~73% of the aggregate voting power due to a dual class share structure where Neves is the only holder of super voting right B shares (one B share carries 20 voting rights).

Further, the Board will not be able to form a quorum without Neves for so long as he remains a director. The Board has the ability to designate the terms of and issue preferred shares without shareholder approval.

Under José Neves' revised compensation plan, he receives no bonus or annual base salary for the period 2021 to 31 December 2028. His PSUs are eligible to vest based on the below stock price hurdles and timeframes. The current stock price is ~$39. While nothing is guaranteed, this is one of the more aligned compensation structures I’ve come across.

Other key executives within Farfetch include Elliot Jordan (CFO), Stephanie Phair (Chief Customer Officer), Judy Liu (President, Greater China), Cipriano Sousa (CTO), and Luis Teixeira (COO).

Valuation

Farfetch does not currently generate GAAP profit or operating cash flow (after reversing out the SBC add back). Excess cash flow is used to reinvest back into the business at attractive returns given the strong unit economics exhibited within the business. This investment takes the form of technology, demand generation and G&A (which includes platform services, production, customer services, account management).

Farfetch trades on 10.4x FY22e EV/GP (4.7x EV/Sales) and is growing its top line at ~30% p.a. While there are no true like for like peers, this shorthand method implies Farfetch is “cheap” versus most other GAAP unprofitable growth names.

My absolute valuation approach is inexact and sensitive to a number of assumptions.

I assume 3% p.a. growth in diluted share count out to FY30e along with an SBC headwind of 2% to terminal EBITDA margins. I forecast a revenue CAGR of 16.4% from FY21e-FY30e compared to 57% from FY17-FY21e. Cash flows are discounted at an 8% WACC resulting in an equity value of $51 today.

In terms of sensitivity, revenue growth is the key driver of forward shareholder returns. A 25% revenue CAGR from FY22e-30e imputes a share price of $94, while a slow down in growth to 10% CAGR gets you a value of $31/sh.

It’s worth noting the pace of operating leverage, level of shareholder dilution and opaqueness of segment level disclosure makes the valuation exercise even harder than normal.

The range of outcomes remains wide and a qualitative view of Farfetch’s place in the luxury industry and growth algorithm and optionality versus its enterprise value today may provide more comfort.

Farfetch provides benefits to different stakeholders across a number of verticals within the luxury ecosystem and is positioned strongly underpinned by its 3P marketplace. If the company continues to execute, the equity is likely worth many times its market value today.

Business Risks

China growth slowdown

China will become Farfetch’s most important market and a key driver of incremental revenue growth. Demand may be temporarily or permanently impaired to the extent that there are regulatory crackdowns on luxury spend or policies that are aimed to improve inequality.

Competition

Farfetch faces competition from brick and mortar retail, other online players and brand.com websites that hold the same inventory. Consumers have little to no loyalty amongst these options and price is often a differentiating factor. The ability for Farfetch to drive brand recognition and a unique value proposition will be essential to its longer term success.

Key Man risk & Private client team

CEO and Founder José Neves is integral to the Farfetch brand and operations. If he were to leave, material question marks would be raised and it could almost be a catalyst to immediately sell the equity.

Members of Farfetch’s Private Client team have a niche skill-set and cater to some of its most important and highest spending consumers. If members of the Farfetch Private Client team leave Farfetch, they could be difficult to replace.

Fingers in many pies

By now, what should be clear is that Farfetch is a broad reaching enterprise with lots going on across multiple interconnected verticals. There are new acquisitions to be integrated, new deals to nurture and a core business that is growing strongly but still needs further investment and attention. The ability for management to manage these growth curves and new ventures successfully is an important ingredient to get to platform scalability and operating leverage over time.

Scaling the business model profitably

Operating a marketplace in luxury is hard work. Farfetch is best positioned to do this profitably and at scale given its investments in technology, logistics and relationships with brands and retailers. There do remain question marks over the attractiveness of the steady state economics of the business at scale given how far away from profitability Farfetch is, and the nascent nature of the luxury marketplace as a concept.

Conclusion

Farfetch is the dominant digitally focused platform for the luxury industry. The company is at the beginning of a long journey in helping to digitise the luxury goods economy in a way that adds significant value to all its ecosystem participants: consumers, brands and retailers.

Led by a long term focused and aligned founder, an investment in Farfetch underwrites a view that Neves and his team will be successful in delivering that goal.

It’s worth noting the range of outcomes still remains wide which should be reflected in position sizing. Farfetch is a classic example of a company that is likely best to average up on should it continue to execute on its promise.

Disclaimer

This report is intended for informational purposes only. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset.

Bain estimates

Gross Profit

Demand generation expense

Another excellent one. Appreciate the effort you put into these

Very thorough and very helpful in getting up to speed on this company. It's been on my "pile" for well over a year to dig into and reading this accomplished 90% of that. Thank you